Buying a home is one of the most significant investments you’ll make. Low mortgage rates have made it easier for people to afford their dream homes over the last dozen years. In 2023, home mortgage rates have been soaring, causing problems for people who want […]

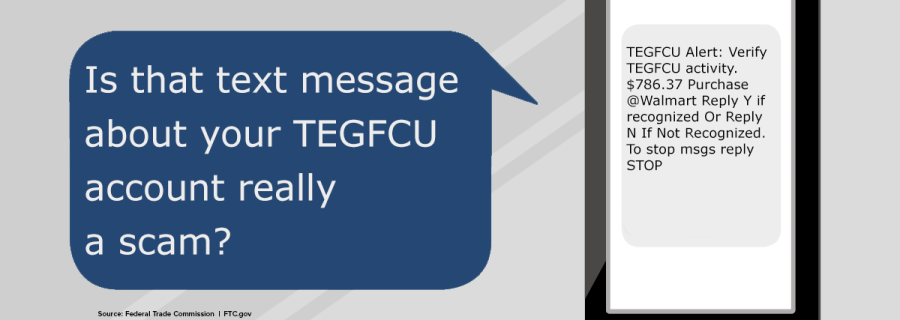

View moreBeware of Text Message Scams

The Federal Trade Commission (FTC) is warning consumers about text message scams. The FTC found that fake bank fraud alerts were the most common text message scam reported in their study. The study also revealed that many popular financial text scams pretend to be from […]

View moreTEGFCU eStatements

Fast. Secure. Convenient. Always Available. Your bank statement is a vital tool for keeping track of your withdrawals and deposits, but more importantly, it also helps you become aware of suspicious activity and possible fraud. Fast – Avoid USPS postal shortcomings, delays, and lost or […]

View moreBack-to-School Shopping Tips

5 Tips for Back-to-School Shopping Students are returning to in-person classes this fall and that also means back-to-school shopping is back. After the pandemic introduced us to online classes (mostly done in p.j.’s and slippers), the kids are going to be excited as they look […]

View moreAnnual Meeting 2021

Our Annual Meeting is an unique opportunity for credit union members to hear about our financial health and community impacts. Time: 5:30 pm Date: Thursday, March 25, 2021 Location: 1 Commerce Street TEGFCU’s Annual Membership Meeting is more than just an event that happens once […]

View moreWebinar: Navigating Your Finances During the COVID-19 Crisis

These are confusing times and we know you have a lot of questions. Join us for a live interactive webinar with our panel of experts, moderated by our Marketing Specialist, Jenny Fox. This is your opportunity to ask the questions that matter to you the […]

View moreHomebuying Coffee Talk

CANCELED Saturday, March 28 9 am — 11 am 1 Commerce St., Poughkeepsie NY 12603 Our Mortgage Officer, Stephanie Barone, will be on hand to discuss the homebuying process over refreshments. Topics will include: -Factors that will affect buying a home -What mortgage lenders look for in […]

View moreWARNING: Scam Alert

Beware of vishing or voice phishing scams that appear to be from financial institutions. If you receive suspicious phone calls asking you to provide your confidential information, you need to be on guard. It could be an attempt to get access to your account or […]

View moreHappy NCSAM!

Held every October, National Cybersecurity Awareness Month (NCSAM) is a collaborative effort between government and industry to raise awareness about the importance of cybersecurity and to ensure that all Americans have the resources they need to be safer and more secure online. NCSAM 2019 will […]

View moreTEG Retirement & Advisory Services – Essential Tax Tips for IRAs

Woe to the taxpayer who runs afoul of the numerous and confusing IRA rules. There are forms to file, contributions to make, distributions to take, and penalties to avoid. While corrections are possible, it’s best to avoid mistakes in the first place. Here’s what you […]

View moreTEG Retirement & Advisory Services – Trade Uncertainty Still Weighing on Capital Investment

Business investment remains a critical component for this economic expansion. Capital expenditures (capex) drive productivity gains (more output per hour worked), which enables economic growth while keeping inflation contained. That helps keep the Federal Reserve (Fed) at bay. We received an important data point on […]

View moreThe time is now, Gen X!

How would you guess Gen X is faring when it comes to retirement saving? Those born between 1965 and 1980 are approaching what should be their peak income years, and many of them have actively contributed to workplace retirement plans, IRAs, and investment accounts. At […]

View moreWomen & Life Insurance

Why don’t women who need life insurance have life insurance? Written by Maggie Meskhi These myths may be getting in the way. Here’s the scenario: You have other people — maybe kids, maybe an older parent — depending on your income, the care you provide […]

View moreInstagram @tegfcu

Work hard, play hard! We are now on Instagram (also known as IG or Insta). Follow us and see all of the fun that we’re having!

View moreMillennial Parents Pay Rent & Bills

Today’s Feature Article: Here’s how many millennials get help from their parents to pay rent and other bills Roughly a quarter of Millennials (ages 25-34) receive some kind of financial support from their parents due to carrying more debt than previous generations did at their age. […]

View more50th Celebration Special Offers

We are focused on providing members with sound affordable financial services to make their lives better. Please visit our Special Offers page or call us at 845-452-7323 to take advantage of our Special Celebration Offers, available for a limited time during 4/22/19-5/31/19.

View moreTaste of Country Ticket Stop

Great country music can drive summer and this ticket giveaway contest has tickets for you to attend this year’s Taste of Country Music Festival. Stop by the following branches on the specified date for your chance to win! Branch TOC Stops Thursday May 2: Commerce […]

View moreCheers to 50 Years!

Did you miss our 50th Annual Meeting & Celebration on March 30? You can view photos from the event along with our Annual Report and the Chairman of the Board’s Message by visiting www.tegfcu.com/50-years.

View moreLocal Reviews Can Help Your Business Rank Higher In Local SEO

Written by Karina Tama-Rutigliano Many facets go into a marketing strategy, and that’s what makes it so interesting. Marketers need to think about who their clients are and what their online search and shopping habits are. They also have to keep a keen eye on […]

View moreHow Family Business Owners Should Bring the Next Generation into the Company

Written by Sam Bruehl & Rob Lachenauer “Go find your passion,’’ Henry directed his children when they reached their late teens and early twenties. “Find your interests outside our family business and pursue them.’’ As inspiring as those words may have been, Henry, the patriarch […]

View moreYou don’t have to be wealthy to put this estate plan into place

Written by Darla Mercado Rich people aren’t the only ones who need a will. Without this legal document your state’s laws will govern how your assets are distributed. Families with young children can add a clause naming a guardian in the event you and your […]

View moreHow small business owners can take advantage of the new tax law before it’s too late

Written by Bill Bischof First-year bonus depreciation has been around for a few years, but the Tax Cuts and Jobs Act (TCJA) installed much more generous (but temporary) bonus depreciation rules. Here’s what small business owners need to know to cash in on the new […]

View moreMillennial women may be on a collision course with financial disaster

Written by Jill Corfield Millennial women seriously lag men in their financial aspirations, compared with data from the same study two years ago. The reasons for this gulf include social media, career goals and family priorities. This financial gap could mean women are setting themselves […]

View moreWhat Surprises Boomer Women Professionals When They Retire

Authors Karen Wagner & Erica Baird We are women on the leading edge of the wave of boomers who have worked for decades and are now starting to retire. We knew, way back in our brains, that one day we would retire. As the date […]

View more