In a High Mortgage Rate Environment – What Are Your Options to Buy a Home?

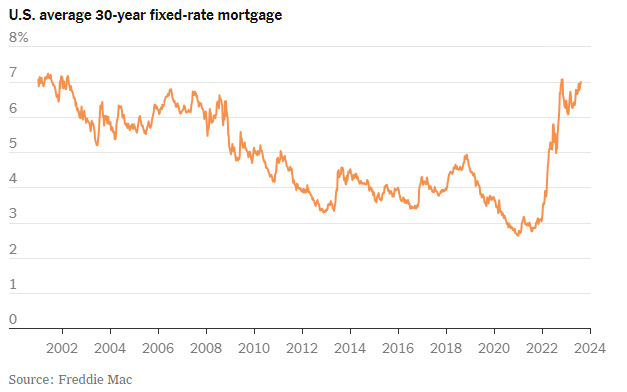

Buying a home is one of the most significant investments you’ll make. Low mortgage rates have made it easier for people to afford their dream homes over the last dozen years. In 2023, home mortgage rates have been soaring, causing problems for people who want to buy a house.

While higher mortgage rates may discourage you from purchasing a home, don’t let it prevent you. There are still several homebuying options, even with higher mortgage rates, that may work for you.

Getting pre-approved is your best option.

Build a strong credit history – A good credit score will help you qualify for a lower interest rate. A strong credit history is essential when applying for a mortgage because it shows lenders that you are a reliable borrower. Lenders see that you pay your bills on time. If you have a strong credit history, you will most likely qualify for a lower interest rate on your mortgage. A lower interest rate will save you money over the life of your loan.

Save more money upfront – Making a larger down payment means borrowing less, which helps you pay less. This can lead to substantial savings over the course of the loan. So, if you’re looking to buy a home with high mortgage rates, consider saving up for a larger down payment.

Buy a less expensive home – If you’re struggling to find a home that fits within your budget, consider buying a less expensive home. While it may not be your dream home, it can still be a home that you love and can afford. Additionally, buying a less expensive home means you’ll have a smaller mortgage payment, saving you money on interest.

Be prepared to make a higher monthly payment – Even with a lower interest rate, your monthly payments may still be higher than expected. Be ready to make a higher payment if necessary. The rule of thumb is to have your housing payment be no more than 30% of your budget.

Things to consider before you apply.

A shorter loan term – A shorter loan term means that you’ll pay less interest over the life of the loan. While a 30-year mortgage may have a lower monthly payment, you’ll pay more interest in the long run. A 15-year mortgage has higher monthly payments, but you’ll pay less interest in the long run.

An Adjustable-Rate Mortgage (ARM) – These loans can be a good option for borrowers looking for lower initial interest rates and more flexibility, especially if you don’t plan to stay in your home longer than the rate lock period. However, it is essential to carefully consider the risks before taking out an ARM. Rates start lower but can rise.

Compare Loan Estimates and Watch Out for Junk Fees – Making a mortgage affordable means not adding unexpected closing costs. Compare our closing costs to other lenders and say no to junk fees. TEGFCU does not charge any fees for applying, originating, brokering, processing, underwriting, mortgage rate locking, wire transferring, or pre-approvals. You won’t find junk fees at TEG Federal Credit Union.

Already preapproved? Let TEG take a second look! – Make sure that you’re getting the best home financing to suit your needs. If you already have a loan estimate for a home mortgage by another lender, TEG would like the opportunity to provide you with our own preapproval decision, so that you can compare. We appreciate your time, and to thank you for allowing TEG to give you a second opinion on your mortgage financing, we will give you $100.

TEGFCU mortgage loan officers can help homebuyers manage mortgage interest rates in a few ways:

- Educate homebuyers about the different types of mortgages available. Many different types of mortgages are available, each with advantages and disadvantages. TEGFCU mortgage loan officers can help homebuyers understand the various options and choose the one that is right for them.

- Help homebuyers understand what it takes to qualify for a mortgage. TEGFCU mortgage officers will explain how boosting your credit score, increasing your down payment, and lowering your debt-to-income ratio can make it easier for homebuyers to qualify for a mortgage, even with high-interest rates.

- Provide competitive rates and flexible terms. TEGFCU has a variety of flexible options and will help you choose the right mortgage for your situation

- Provide excellent customer service. TEGFCU has a reputation for providing excellent customer service. TEG is known for having friendly, local experts who go the extra mile. We will guide you through the complicated mortgage process from start to closing so you can have the best experience possible.

First-time Homebuyer?

On the first Wednesday of each month at 5:30 p.m., TEG virtually hosts a Free Homebuyer Webinar. First-time homebuyers receive $500 off closing costs if they close on a TEGFCU mortgage within 12 months of attending. You can register for this free webinar on what to expect during the homebuying process here.

While high mortgage rates can make things challenging for potential homebuyers, buying a home is not impossible. You need to be strategic and explore different options.

If you are a homebuyer scared about rising mortgage interest rates, talk to a TEGFCU mortgage loan officer. They can help you understand your options and find the best mortgage for your needs. You can choose a loan officer by clicking here.

Watch NBC’s Vicky Nguyen report for TODAY on how high mortgage interest rates impact the market.

With these options, even first-time homebuyers can manage high mortgage interest rates and still achieve the dream of homeownership.