Trying to maximize your savings? That’s smart! But let’s face it, finding the right place to invest that hard-earned cash can be a bit tricky. Why? Well, the financial world can be like a roller coaster – unpredictable and rapidly changing. But don’t worry, we’re […]

View more2024 TEG Annual Meeting

YOU are the reason we love what we do—improving lives. Helping people get to a better place financially. Member Focused. Member Driven. Together Everyone Grows. Over the past five decades, TEG has grown to serve over 37,000 members and is approaching $420 million in assets. […]

View moreFree Community Shred Events

Scam Alert – Members Beware – Telephone and Text Scams

Please be aware of a phishing telephone scam that some credit unions across the country are reporting more frequently. Members are receiving phone calls from fraudsters posing as a credit union employee, who tell them that their account has been compromised or that their credit/debit […]

View moreBeware of Online Quiz Scams

How to Use Zelle to Safely Send Money

Postal Mail Theft

If you live in Hudson Valley, it’s time to get on the defensive regarding mail theft. With rising reports of statements, packages, letters, and other important documents going unchecked due to a significant increase in mail thefts across the state, this is not something NY […]

View moreTEGFCU eStatements

Fast. Secure. Convenient. Always Available. Your bank statement is a vital tool for keeping track of your withdrawals and deposits, but more importantly, it also helps you become aware of suspicious activity and possible fraud. Fast – Avoid USPS postal shortcomings, delays, and lost or […]

View moreAnnual Meeting 2023

This year’s 54th Annual Meeting was held: March 30, 2023, 5:30 PM 1 Commerce Street, Poughkeepsie, NY, 12603 Each year, TEG Federal Credit Union hosts an Annual Meeting. Our Annual Meeting is a unique opportunity for credit union members to hear about our financial health […]

View moreTEG 2023 Scholarships

Student Scholarships Available We’re ready to support the future generations of our communities. Our scholarship program is an investment in our future and yours. With a solid education, we can all make a difference. TEG Federal Credit Union will award three $1,000.00 scholarships to graduating […]

View moreKeep Yourself Safe from Scams and Fraud

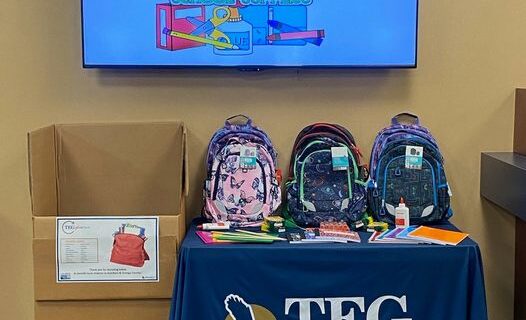

Back-to-School Drive

It’s almost time for kids to head back to school. Let’s help ensure that every student has the basic supplies they need to succeed! At TEG FCU, we feel it is both an honor and privilege to give back to the communities we serve. After […]

View moreUnderstanding Mortgage Closing Costs

Closing costs are important fees that you should know about if you are considering applying for a mortgage. These fees vary depending on the lender and are usually 2% to 6% of the amount you are borrowing. By understanding how closing costs work and which […]

View moreSign up for eStatements & be entered to win a $100 Adam’s Gift Card

Sign up for e-Statements and get entered to win one of three $100 Adams Fairacre Farms Gift Cards! We at TEG Federal Credit Union don’t want you to get e-Statements because it’s green. Saving trees and time is a great reason for you to want […]

View moreAnnual Meeting 2022

Our Annual Meeting is an unique opportunity for credit union members to hear about our financial health and community impacts. It is a solid commitment by staff, members and volunteers to keep the credit union vibrant and growing. We invite all members to learn about […]

View moreNew: Credit Card Fraud Alerts

At TEG Federal Credit Union, we’re serious about protecting you from fraudulent activity on your accounts. That’s why we’ve strengthened our defenses with a new, automated system that can identify threats faster, notify you sooner and equip you with the tools you need to take […]

View moreWill Refinancing My Car Help Or Hurt My Credit Score?

Your credit score can impact many factors of your life. Everything from insurance and interest rates to how much you can borrow for a mortgage relies in some respect on your credit score. A great credit score can open many doors, but the opposite also […]

View moreIs 0% Financing The Best Rate You Can Get For An Auto Loan?

0% financing on a car loan almost sounds too good to be true. It seems like the best deal on the surface, but is it really? The truth is, 0% financing through a dealership can actually cost more than a low APR loan through a […]

View moreBack-to-School Shopping Tips

5 Tips for Back-to-School Shopping Students are returning to in-person classes this fall and that also means back-to-school shopping is back. After the pandemic introduced us to online classes (mostly done in p.j.’s and slippers), the kids are going to be excited as they look […]

View moreFraud Alert: Online Retailer Scam

With online shopping becoming increasingly popular for people this year, the Better Business Bureau warns that scammers are using the name of popular retail companies to steal individual’s money and information. The “2020 BBB Scam Trackers Risk Report” found that online purchase scams made up […]

View moreThree Good Reasons to Refinance Your Mortgage

Saving more on your mortgage doesn’t need to be difficult. Backed by historically low rates and community-based member service, refinancing your home mortgage with TEG FCU has never been easier! 1. To take advantage of lower interest rates Refinancing a home loan with a lower […]

View more2021 Annual Meeting

Our 52nd Annual Meeting was held on Thursday, March 25, 2021. You can view the live recording of our Annual Meeting and the Chairman of the Board’s Message in the video below! You can view a copy of the 2020 Annual Report here.

View moreAnnual Meeting 2021

Our Annual Meeting is an unique opportunity for credit union members to hear about our financial health and community impacts. Time: 5:30 pm Date: Thursday, March 25, 2021 Location: 1 Commerce Street TEGFCU’s Annual Membership Meeting is more than just an event that happens once […]

View moreTEG Retirement & Advisory Services- Financial Fitness Checklist Workshop

This checkup covers all the important aspects of your life: family, goals, business or work, health, money, estate, retirement, and your future. It can help you identify those areas that could use some attention. After you’ve finished the checkup, taking steps now to improve your […]

View moreWants vs. Needs

What is a “want?” And what is a “need?” While everyone has their own wants and needs, being able to differentiate between the two can be difficult. Being able to clearly define each can help you improve your savings, which can help you build up […]

View moreFinancial Checklist

As you prepare to pack up holiday decorations and say goodbye to an unprecedented year, don’t close the book on this year just yet. Set yourself up for success by reviewing your finances before January 1. Grab your favorite mug, fill it with hot chocolate, […]

View moreTEG 2022 Scholarship

TEG Federal Credit Union will award three $1,000.00 scholarships to graduating high school seniors who have demonstrated academic achievement and community service throughout their high school careers. From time to time TEG may, at its own discretion, add a fourth $1,000 scholarship to be awarded […]

View moreFour Finance Topics Every Kid Should Know

It’s never too early to learn how to handle your money. Imagine if your child were suddenly about to move out but never learned how to manage an income. The things kids need to now about finances are not that different than what adults need […]

View moreBeware of Cash App Scams

Money transfer apps including Cash App, Zelle, and Venmo have gained popularity during the pandemic as people seek contactless ways to exchange money. These Peer-to-Peer (P2P) payment platforms make it convenient to send someone money directly from your linked checking account. Unfortunately, they also can […]

View moreCovid Update

We’re monitoring the coronavirus situation and offering help when you need it. The health and safety of our members and staff remains our top priority. TEGFCU continues to closely monitor the uptick in active Covid-19 cases in the mid-Hudson Valley. We are heeding all guidance […]

View moreInternational Credit Union Day 2020

International Credit Union (ICU) Day celebrates the spirit of the global credit union movement. Today is recognized to reflect upon the credit union movement’s history, promote its achievements, recognize hard work and share member experiences. International Credit Union (ICU) Day has been celebrated on the […]

View moreSelling Your Home During COVID-19

Selling a home is a move people generally plan years in advance, and 2020 was no different. For many homeowners, the hot real estate market of spring and summer of 2020 was going to be the season they put their homes up for sale. And […]

View moreHow Can I Protect Myself from Payment App Scams

Q: I love the convenience of payment apps, like Cash App and Venmo, but I’ve heard there’s been an increase in scams being pulled off within these apps. How can I continue to use my payment apps without compromising my safety? A: Payment apps offer […]

View more4 Ways to Celebrate National Financial Awareness Day

With all the uncertainty and financial ups-and-downs this year has given us, it’s important we take a step back and reevaluate, reassess, and regroup. Financial awareness means different things to different people. For some, it comes with the awareness and monitoring of a savings or […]

View more5 Back to School Apps for Parents and Students

The new 2020 school year is just around the corner and whether your kids are getting ready for another round of remote schooling via Zoom or they’re packing their backpacks with face coverings and hand sanitizer for in-person classes, there’s at least one app to […]

View moreIRS Reveals List of “Dirty Dozen” Tax Scams for 2020

Each year, the IRS publishes the “Dirty Dozen,” a list of tax scams most prevalent during that year’s tax season. This year, with COVID-19 pushing off the federal tax deadline to July 15, the IRS held off publishing the list until early July, and of […]

View moreYour Guide to Using Credit Cards

Q: I’d love to improve my credit score, but I can’t get ahead of my monthly payments. I also find that my spending gets out of control when I’m paying with plastic. How do I use my credit cards responsibly? A: Using your credit cards […]

View moreHow to Read a Paystub

Having your paycheck directly deposited into your checking account can be super-convenient, but it can also lead to being unfamiliar with your paystub. It’s important to review your paystub occasionally to check for possible errors and review the deductions, as your accountant suggests. No worries, […]

View moreLife Lessons Learned During the COVID-19 Pandemic

If someone would have approached us a year ago and told us that, in 2020, the country would essentially shut down for three months; the busiest thoroughfares in cities across the world would be empty of traffic; schools and colleges would close for an entire […]

View moreMy Savings has Been Wiped Clean; How can I Replenish it?

Q: The last few months have been really tough on my finances, and I’ve been forced to use my savings for getting by. My emergency fund and savings account are basically zero. Now that my financial situation is starting to improve, I’d like to start […]

View moreHow to Create and Keep Strong Passwords

Your passwords are the keys to your life. And when it may feel like there’s another big security breach every other week, you want to be sure your passwords are strong and safe. Below are 6 steps for super-strong passwords that will keep scammers guessing. […]

View moreTEG Retirement & Advisory Services- Webinar: Midyear Outlook

Please join us in welcoming a very special guest from our own broker/dealer, Scott Brown who is an analyst with LPL Research. He serves a member of the LPL Financial Research investment management committee where he helps to develop and articulate market trends and technical […]

View moreWhy Your Next Car Loan Should be From a Credit Union

15 Incredible Grilling Hacks

Nothing says “summer’s coming” like the mouthwatering smell of a flaming barbecue blowing through the neighborhood. Whether you churn out the best burgers on the block from a modest charcoal grill or your Weber’s been squatting on your deck all winter, we’ve got you covered! […]

View more5 Ways to Pay off a Loan Early

If you’re like most Americans, you probably owe money toward a large loan. Whether that means carrying thousands of dollars in credit card debt, having a hefty mortgage in your name or making car loan payments each month, loan debt is part of your life. […]

View more7 Ways You Can Use a Personal Loan This Summer

Summer is a time for fun and excitement, but it can also be super expensive. Before you start swiping the plastic for everything under the sun, we recommend considering a personal loan to stay within your budget. At TEG, the application process is smooth and quick. […]

View moreFinancing a Home Renovation with a Home Equity Loan

Q: I’m doing some home renovations, and I’m not sure how to finance it all. Do I take out a loan? Should I just charge all the expenses to my credit card? There are so many options! Which one makes the most sense for my […]

View moreTEG Retirement & Advisory Services- Webinar: Financial Wellness

Please join us on Thursday, June 25th for a conversation on Financial Wellness: Guidance for Each Stage of Life. Thursday, June 25, 2020 2:00 PM Featuring Jackie Wilke, Advisor Consultant Join us with special guest, Jackie Wilke, Advisor Consultant at First Trust Portfolios L.P.. With […]

View moreYour Personal RV Buying Guide

How to Create a Budget in 6 Easy Steps

If you’re always wondering how you’re going to pay the next bill, feel guilty when you indulge in overpriced treats and you can’t seem to find money to put into savings, then you probably need a budget. A budget is not a magic potion that […]

View more