TEGFCU Personal Checking Account

Convenience Doesn’t Have to Cost a Thing

Keep more of your hard-earned money and manage your account anytime, anywhere with our TRULY-FREE CHECKING account from TEG Federal Credit Union. Plus, you’ll earn great rewards on everyday purchases!

No Monthly

Maintenance Fee

No Minimum

Balance

Requirement

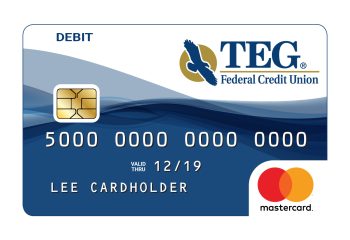

Free Mastercard

Debit Card

Free 24/7

Digital Banking

Access

Free Bill Pay

Free ATM

Withdrawals at

TEG ATMs

Free

SavvyMoney

Credit Monitoring

Convenient

Mobile

Deposits

Overdraft Protection Available

Sometimes, mistakes happen. Perhaps you thought you had enough money in your checking account to cover a check, debit card transaction, automatic payment, or ATM withdrawal, but you didn’t. Don’t worry! We offer three great options to help you prevent your checking account from being overdrawn.

Overdraft Privilege

All members with a TEG Checking Account in good standing have $500 in Overdraft Privilege available to them after their account has been open for 30 days. This helps you avoid being charged a returned item fee by the merchant and stay in good standing with them. After the overdraft is paid, you’ll have 30 days to make a deposit to bring your checking account to a positive balance.

With Overdraft Privilege:

- TEG has the option to cover checks you’ve written or bills you’ve paid, and you will be charged a $33 fee for each item paid.

- If you want Overdraft Privilege to cover ATM or debit card overdrafts (purchases and cash withdrawals), you must enroll in Debit Card Overdraft Privilege by filling out the form below. Otherwise, we cannot pay these items.

- The amount of the Overdraft Privilege is not shown in your available balance but may be available to you for checks, telephone and online banking, ACH transactions, and ATM cash withdrawals or debit card purchases if you’ve selected that option.

If you have already signed up for overdraft protection from another account, funds will first be transferred from the account you’ve designated to cover the overdraft. If sufficient funds aren’t available in that account, or if the transfer isn’t enough, the overdraft will be paid through Overdraft Privilege.

Overdraft Privilege is not a line of credit, and this notice does not constitute either a written agreement of an obligation or a prearranged agreement to pay your overdraft. We may withdraw this privilege at any time. Please review our Overdraft Privilege policy.

To enroll in Overdraft Privilege for ATM and Debit transactions, please fill out the following form to enroll in our Overdraft Privilege programs for ATM and one-time debit transactions.

Overdraft Savings Transfer

With Overdraft Savings Transfer, you can protect your checking account by linking it to your savings account. If you don’t have enough money in your checking account to cover your ATM withdrawals, debit card purchases, checks, and online bill payments, funds will automatically be transferred from your savings account to cover the difference. A small fee is charged for each transfer.

We recommend Overdraft Savings Transfer if:

- You occasionally overdraw your checking account.

- You have savings funds available to cover any overdrafts.

- You only want to pay for your plan if you use it.

If you also sign up for Overdraft Privilege, funds will be transferred from your designated savings account first and Overdraft Privilege will be used to cover any shortfalls.

Overdraft Line of Credit

An Overdraft Line of Credit is a good alternative for protecting your checking account if you don’t want to link to your savings account or rely solely on Overdraft Privilege. Once your Overdraft Line of Credit is approved, you’ll be advanced the necessary amount to cover your purchase or withdrawal (up to your credit limit, of course).

- Lines available up to $1,000

- Variable interest rate

- Advances are made in $50 increments

- You pay interest only on what you use (until you pay the amount back)

We recommend an Overdraft Line of Credit if:

- You occasionally overdraw your checking account.

- You want the added capacity and flexibility offered by a line of credit.

- You monitor your account activity and repay advances from your line of credit.

If you also sign up for Overdraft Privilege, funds will be transferred from your line of credit first and Overdraft Privilege will be used to cover any shortfalls.

For more information about protecting your checking account from overdrafts or help deciding which overdraft protection option is best for you, give us a call at (845) 452-7323 or visit any of our branch locations. We’ll be happy to help you!

Get the TEGFCU Rewards Debit Mastercard

Life is more rewarding when you bank with TEG! When you have a Free Checking Account, we give you points toward earning fantastic rewards for the purchases you make every day with your debit card.

Your account also comes with a TEG Rewards Debit Mastercard®, so you’ll be rewarded for the purchases you make every day. Learn more about TEG’s Debit Rewards Program.

- Earn and redeem points for great rewards like travel, gift cards, and more!

- Keep your account safe from fraud with Free Zero Liability Protection.

- Use it anywhere Mastercard is accepted.