BUSINESS LOANS

Local Decisions

Personalized Service

Flexible terms

Competitive Rates

Knowledgeable Experts

Community Partner

PRODUCTS

WHY Choose TEGFCU For Your Business?

Talk to an Expert. Give Michael a Call Today.

Business Development Officer

Office:

Mobile:

A seasoned professional, he personally knows what it is like to be an entrepreneur and can use his expertise to find the best solutions to help your business grow. Known as a natural light photographer, he has taken his pictures from a hobby to a professional level. He is passionate about wildlife and nature photography but also specializes in outdoor portraits and Real Estate photography.

Michael is a lifelong Hudson Valley resident and resides in Dutchess County.

WHAT MAKES OUR LENDERS DIFFERENT

WHO CAN APPLY?

FAQs

TEG Federal Credit Union is a member-owned financial cooperative that exists to serve the financial needs of our members. Businesses located in and/or do business in Dutchess, Orange, Putnam, Rockland, Sullivan, Ulster, or Westchester Counties are eligible for business accounts at TEGFCU. Eligible business entities include Sole Proprietorship/DBA (Doing Business As), Organization, Corporation, Subchapter “S” Corporation, Limited Liability Company (LLC), Partnership, and Limited Liability Partnership (LLP).

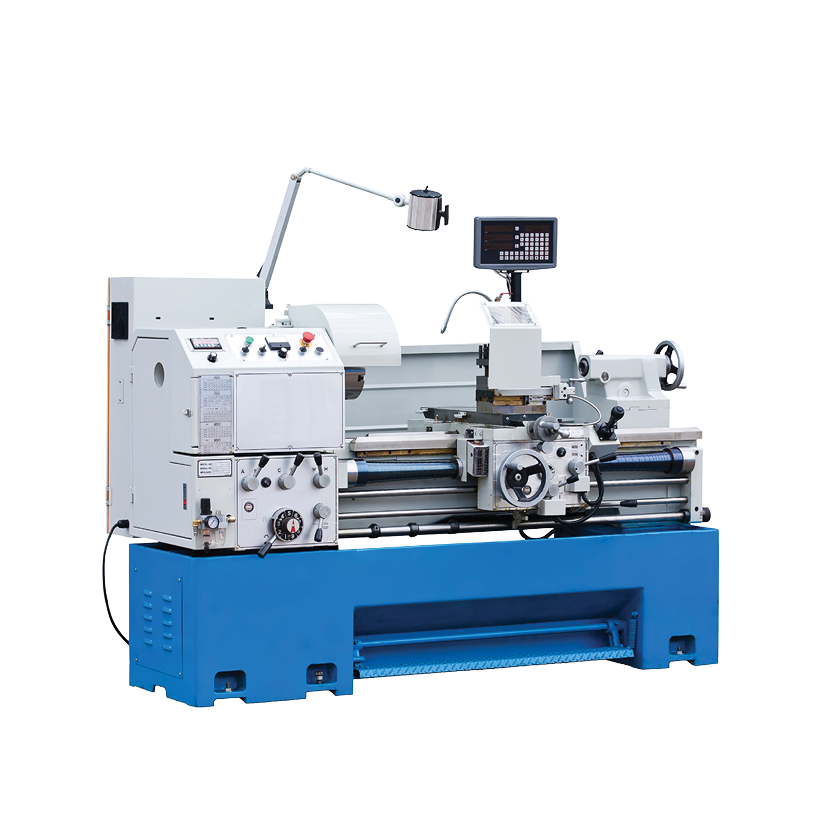

You can use the loan for many business-related needs, such as real estate, equipment and supplies, vehicles, working capital and construction and more.

Loan interest rates vary based on the specific product and can fluctuate. However, TEG offers very competitive rates. Our Commercial Lenders will gladly walk you through any questions you may have about specific interest rates and help to determine what your interest rate will be based on the needs of your business.

We will ask for basic information about you and your company for the loan application. This may include a review of your credit history, your business and personal tax returns, bank statements, balance sheet, profit & loss statement, a list of your assets and debts, business plan or other financial documents. Our business lending experts can help get you started and make it as easy as possible.

The process and the timeline to receive funding varies depending on your business and the loan product. It will depend on your unique financial situation (credit rating, annual revenue, etc.) and the amount of funding you request.

Once your TEGFCU business loan is approved and everything has been signed and finalized, we will transfer your funds directly into your TEG business bank account for further disbursement.

Depending on your repayment plan, business loan repayments typically start right away.

TEGFCU has provided loans to many business owners in the Hudson Valley. With uncommon service, we are adept at helping you navigate your financing options and tailoring your loan to the needs of your business. Take advantage of business financing from local, knowledgeable experts who care about you and your business. We pride ourselves on making long-term business relationships. All lending decisions are made in-house and we make financing simple so you can focus on what really matters – growing your business.