Your Digital Banking Enhanced Experience!

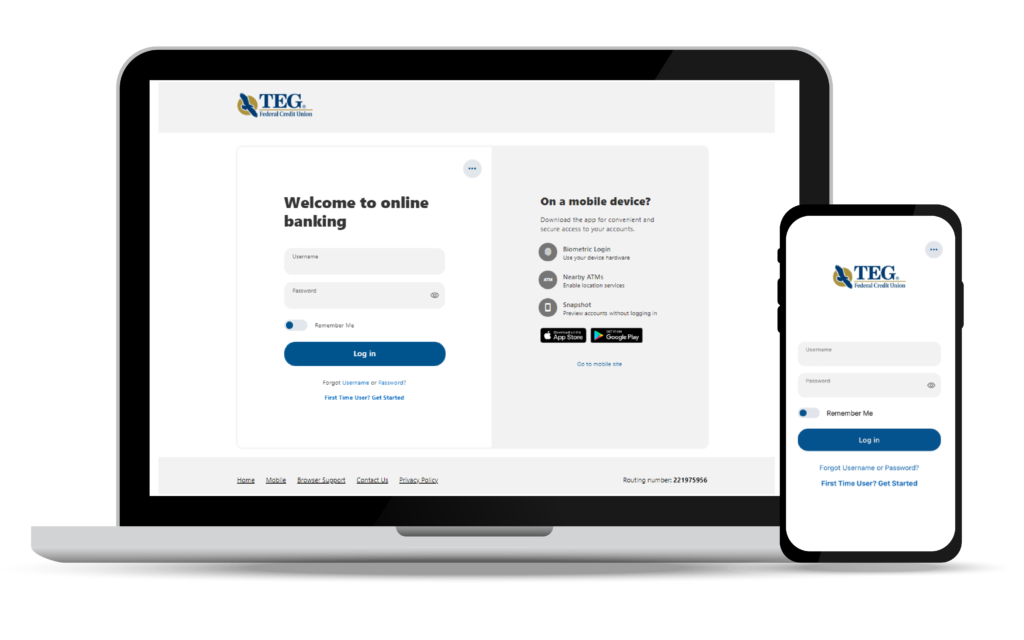

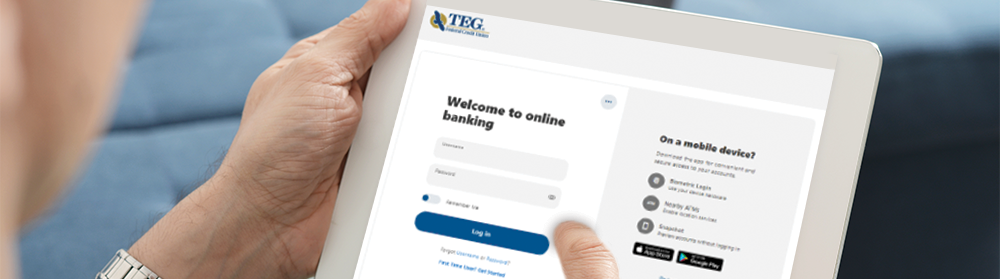

As part of our ongoing effort to provide you with state-of-the art services, convenience, and security, we will be upgrading our current Internet Banking, Mobile Banking, and Bill Pay systems.

Need-to-know information for TEGFCU members:

Digital Banking Features | Digital Banking Guide | FAQs

We are taking digital banking to the next level by providing our members with feature enhancements designed to deliver a quick, seamless, and more intuitive experience than ever before.

Features

✓ Enhanced Security – Protect your money and personal financial information with increased security features and alerts.

✓ Customize your Dashboard – Personalize your digital banking experience. Pick your own profile image, backgrounds, nicknames, and the ability to rearrange your dashboard the way you want it.

✓ An Enhanced Bill Pay System – A simplified system that lets you manage your payments online with less effort.

✓ Better Card Management – Turn your credit & debit card on and off, set alerts, and travel notifications.

✓ Manage All Accounts in One Place – See the accounts you have at other financial institutions right alongside your TEGFCU accounts.

✓ Streamlined Personal Financial Management Tools – New easy-to-use tools will help you manage your money and monitor your financial health. Know your credit score. Create savings goals. Set up direct deposit. And more!

✓ My Credit Score – View your credit score right from your digital banking dashboard.

✓ Snapshot – View account balances quickly without logging in.

✓ Skip-A-Pay– Easily determine if your loan is eligible to skip your loan payment.

✓ Direct Deposit – Easily set up Direct Deposit right in digital banking using ClickSwitch.

Getting Started – Important Login Information

Existing Members with Online Banking

✓ Initial Login– Whether you use internet banking exclusively or use it with mobile banking, you can login for the first time using either service. Our new Digital Banking systems will use the same login credentials.

- Your username is the same one that you used previously for Internet Banking and Mobile Banking.

- After your initial login to the new system, you will be prompted to change your password. Password length will now be a minimum of 12 characters for added security.

- If you have more than one username, then each username will be given access to our new systems.

First Time, New Users

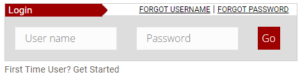

If you are a new or existing member and want to enroll in digital banking, click the First Time User? Get Started link under the login box. You will then be prompted to verify protected information that matches the information on your account and accept the Digital Banking Agreement and Disclosure.

If you are a new or existing member and want to enroll in digital banking, click the First Time User? Get Started link under the login box. You will then be prompted to verify protected information that matches the information on your account and accept the Digital Banking Agreement and Disclosure.

Digital Banking First Time Login

You’re going to love your digital banking experience!

Created with you in mind, our digital banking system will make it easier to bank anywhere, anytime, like never before.