September’s Economic Snapshot: What It Means for You

Published on October 9, 2025

As we move through the fall season, recent economic data gives us an important look at how the job market and housing trends are shaping up, especially with the federal government shutdown delaying official reports. Here’s what we’re watching at TEG Federal Credit Union and how these trends could impact our members.

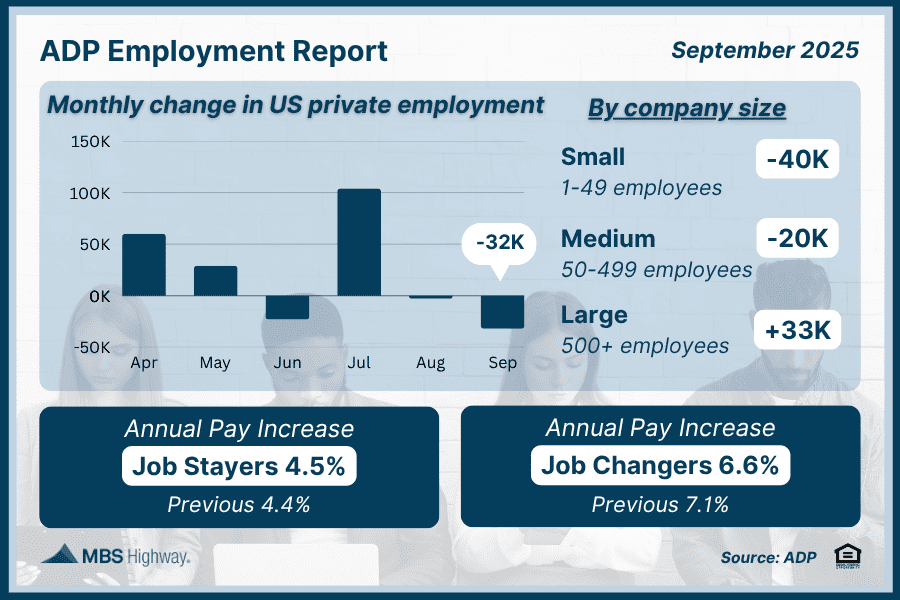

Private Sector Job Growth Slows in September

According to ADP, the private sector lost 32,000 jobs in September, a sharp contrast from expectations of a 50,000-job gain. August’s data was also revised from a modest gain to a small loss, continuing a recent pattern of slower growth.

Job losses were widespread, particularly among small and mid-sized businesses. However, large companies and the education and health services sector added 33,000 jobs each.

Wages continued to grow, though at a slower pace. Workers who changed jobs saw a 6.6% annual increase, while those who stayed put experienced 4.5% rise.

TEG’s takeaway: The job market is showing signs of cooling, as employers grow more cautious with hiring. While the overall economy remains solid, we may see continued moderation in job growth in the months ahead.

Government Shutdown Delays Official Jobs Data

This month’s ADP report carries extra weight because the Bureau of Labor Statistics (BLS) official jobs report has been delayed due to the government shutdown. This also means weekly unemployment claims data will be postponed.

This delay comes at a pivotal time for the Federal Reserve. With inflation still above target and economic growth slowing, the Fed’s next rate decision, scheduled for October 29, will depend heavily on alternative data like ADP’s report.

TEG’s takeaway: When the Fed adjusts interest rates, it changes the Federal Funds Rate, which is the short-term rate banks charge each other. This doesn’t directly affect mortgage rates, but it influences them, along with other economic factors.

Job Openings Remain Limited

The number of job openings in August inched up slightly to 7.2 million, but overall demand for workers remains much lower than in recent years. The hiring rate (3.2%) and quite rate (1.9%) are both near decade lows, signaling fewer opportunities and less confidence among workers.

In 2022, there were over two job openings for every unemployed worker. Today, that ratio is roughly one-to-one, showing a much tighter labor market.

TEG’s takeaway: The job market remains steady but is clearly showing, which could influence consumer confidence and future spending.

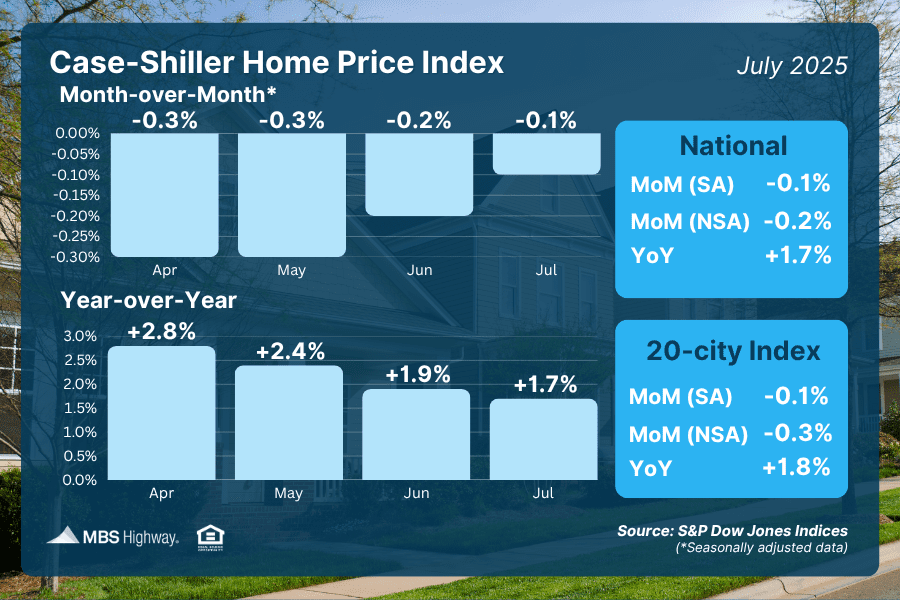

Home Price Growth Eases

Home prices dipped slightly in July, according to both the Case-Shiller and FHFA Home Price Indexes. Nationally, prices are still up compared to last year, but growth as slowed to around 1.7% to 2.3%.

TEG’s takeaway: While prices remain elevated, the market is stabilizing. If mortgage rates continue to ease, buyer demand may strengthen again later this fall.

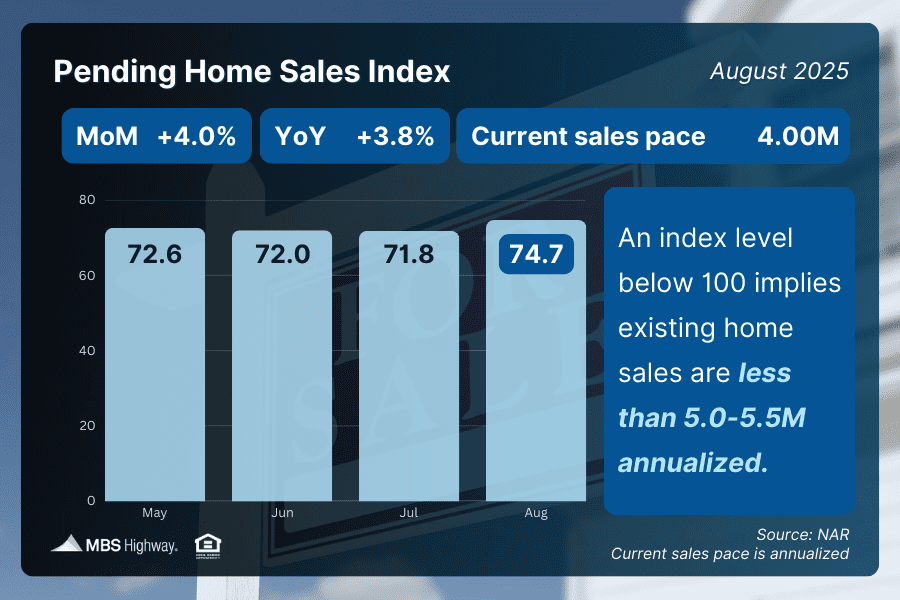

Pending Home Sales Rebound

There’s good news for housing activity: Pending home sales rose 4% in August from July and are up nearly 4% year-over-year. This rebound came as mortgage rates began to trend lower toward the end of summer.

TEG’s takeaways: While prices remain elevated, the market is stabilizing. If mortgage rates continue to ease, buyer demand may strengthen again later this fall.

Final Thoughts from TEG

Economic shifts like these can impact everything from mortgage rates to savings yields. At TEG Federal Credit Union, we’re here to help our members navigate these changes with confidence, whether you’re buying a home, refinancing, or simply keeping an eye on market trends.

If you’d like to learn more about how current conditions could affect your financial goals, stop by your local branch or connect with us online. Our team is always ready to help you make informed, confident financial decisions.

More Recent Posts