Home Sales Move Higher as Inflation Meets Expectations

Published on January 22, 2026

Inflation data for December came in right in line with expectations — and that stability, combined with lower interest rates, helped give the housing market a much-needed lift. In this housing market update, inflation and home sales are closely connected and continue to shape market trends.

Existing home sales posted their strongest pace in nearly three years, new home sales remained near recent highs, and economic data continues to point toward a slowly cooling but resilient economy.

Here’s a breakdown of what the latest numbers mean — and why they matter for buyers, sellers, and homeowners.

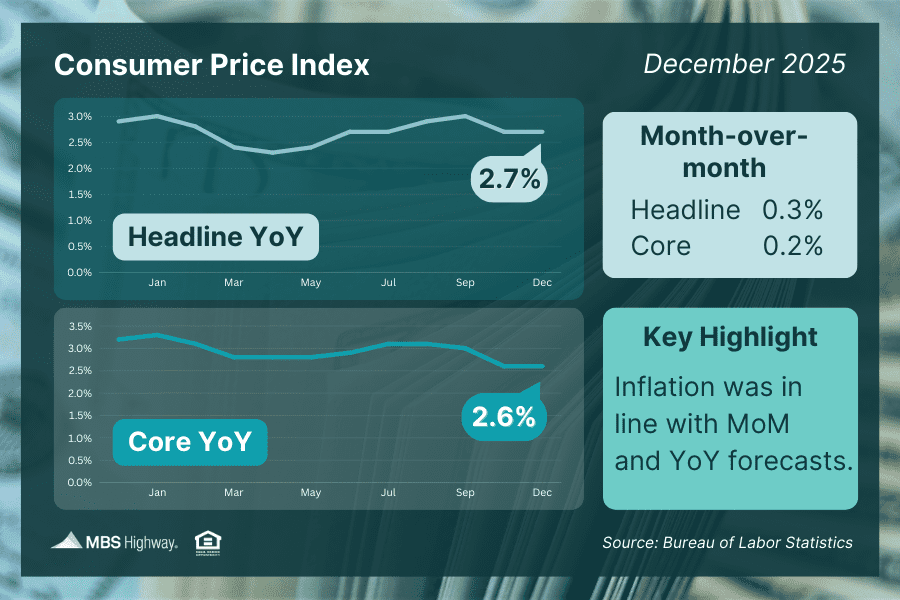

Consumer Inflation in Line With Forecasts

Consumer prices increased 0.3% in December and were up 2.7% year over year, unchanged from the previous report.

Core inflation — which excludes food and energy — rose 0.2% for the month and held steady at 2.6% annually, its lowest level since early 2021.

Overall, the data closely matched economists’ expectations.

Why shelter costs matter

Housing-related expenses remain the largest contributor to inflation:

- About 35% of headline CPI

- Roughly 44% of core CPI

Even small monthly changes in shelter costs can significantly impact inflation readings. In December, shelter prices edged higher, contributing to the overall increase.

What’s the bottom line?

The Federal Reserve continues walking a careful line:

- Inflation pressure remain, suggesting caution on rate cuts

- Labor market data is cooling, increasing pressure to ease policy

Last fall, the Fed lowered its benchmark Federal Funds Rate by 25 basis points three times. While this rate does not directly determine mortgage rates, it strongly influences borrowing costs throughout the economy.

Fed Chair Jerome Powell has emphasized that there is “no risk-free path,” meaning future decisions will depend heavily on how inflation and employment data evolve.

Bottom Line: Inflation is improving — but not yet low enough for the Fed to declare victory.

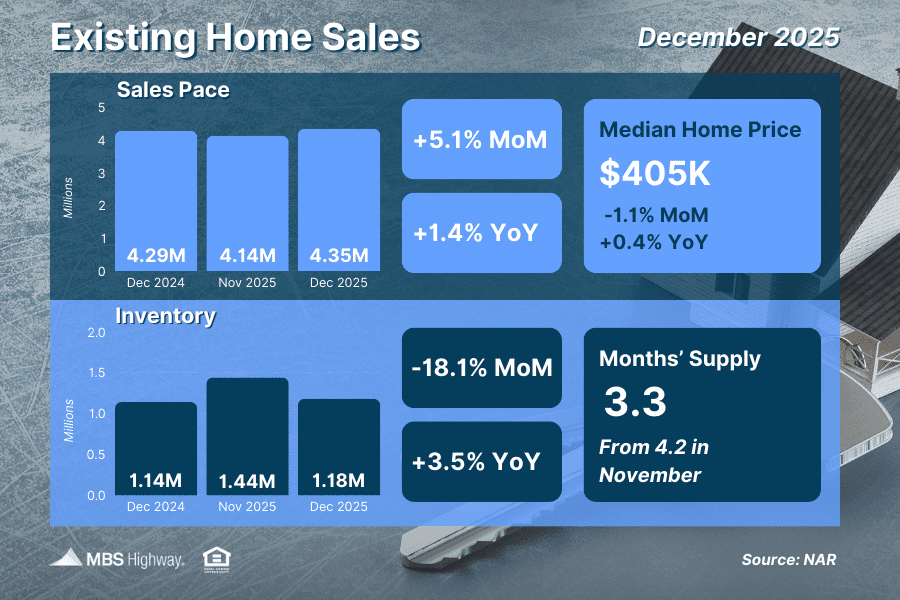

Existing Home Sales Reach Nearly Three-Year High

According to the National Association of

REALTORS ® (NAR):

- Existing home sales jumped 5.1% in December

- Marked the fourth consecutive monthly increase

- Sales were 1.4% higher than one year ago

Inventory update

- Housing inventory fell 18.1% from November to 1.18 million homes

- Still 3.5% higher than last year, offering modest improvement

What’s the bottom line?

NAR Chief Economist Lawrence Yun noted that December sales represented the strongest level in nearly three years.

The key drivers:

- Lower mortgage rates late last year

- Slower home price growth

- Improved buyer confidence

If rates remain relatively stable, buyer demand could continue building as we move toward the spring homebuying season.

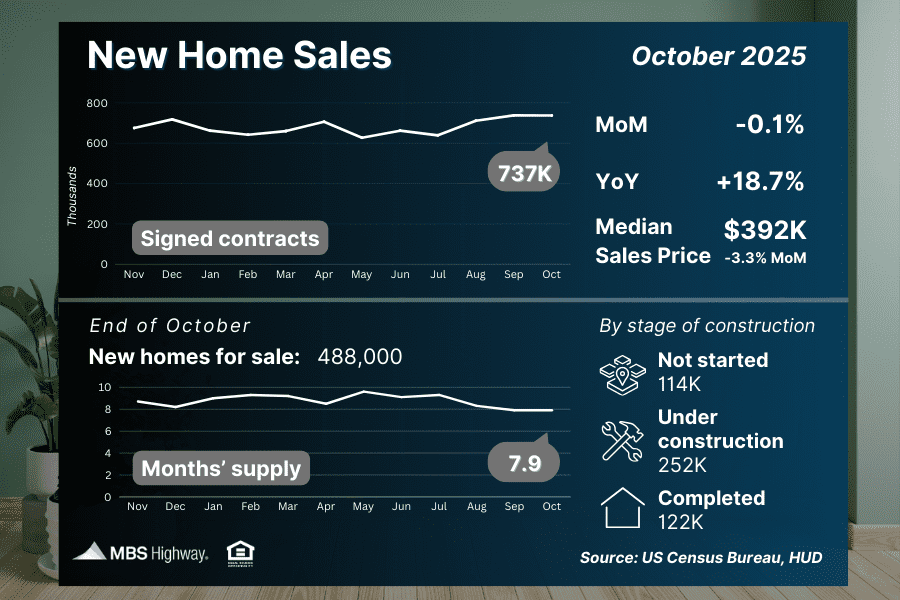

New Home Sales Remain Near Recent Highs

New home sales slipped just 0.1% to an annualized pace of 737,000 units, based on delayed government data.

Even with the slight dip:

- Actively remained near the fastest pace since May 2023

- Sales exceeded economists’ expectations

- Reflected contracts signed when mortgage rates were falling

Supply challenges continue

At the end of October:

- 488,000 new homes were available — one of the highest levels since 2007

- Only 122,000 were completed and move-in ready

Most inventory remains:

- Under construction

- Or not yet started

Long permitting timelines and construction requirements limit how quickly builders can increase finished housing supply.

What’s the bottom line?

Lower mortgage rates continue to support buyer demand, helping keep new home sales resilient.

However, limited move-in-ready inventory means that:

- Strong demand could return quickly

- Home prices may face renewed upward pressure if rates continue falling

Additional Economis Takeaways

Labor market

The job market continues to show what economists describe as a “low-fire, low-hire” environment:

- Initial jobless claims fell by 9,000 to 198,000

- Continuing claims declined by 19,000 to 1.884 million

- Claims have remained elevated for much of the past year

Producer inflation

Delayed November Producer Price Index (PPI) data showed:

- Wholesale inflation up 0.2% month over month

- 3% from a year earlier

Higher energy costs contributed to the increase.

Retail sales

Retail spending surprised to the upside:

- Sales rose 0.6% in November

- Rebounded from a revised 0.1% decline in October

- 10 to 13 retail categories posted gains

The data points to a solid start to the holiday shopping season and continued consumer resilience.

The Bottom Line

- Inflation is cooling and meeting expectations, but shelter costs remain a challenge.

- Lower interest rates helped lift both existing and new home sales.

- Housing inventory is improving slightly, though move-in-ready homes remain limited.

- Economic data suggests steady growth with gradual cooling — not a sharp slowdown.

As we head deeper into the new year, mortgage rates, inflation trends, and labor market data will continue to play a critical role in shaping housing market activity.

For buyers and homeowners alike, staying informed — and prepared — will be key as opportunities begin to open.

More Recent Posts