Softening Job Growth & Slower Home Construction: What It Means for the Economy

Published on January 15, 2026

The Big Picture

Recent economic data shows two important trends taking shape: job growth is slowing, and new home construction is losing momentum. While neither points to an immediate crisis, together they signal a cooling economy that could impact workers, businesses, and future homebuyers.

Here’s a breakdown of what the latest reports are telling us — and why they matter.

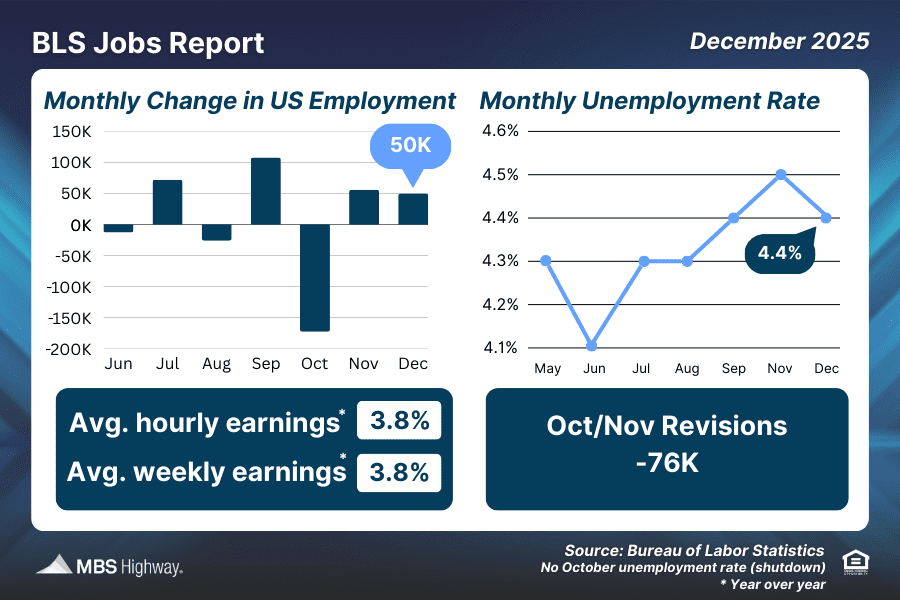

A Closer Look at December’s Jobs Report

The Bureau of Labor Statistics reported that 50,000 jobs were added in December, falling short of the expected 73,000. Meanwhile, the unemployment rate edged down slightly from 4.5% to 4.4%.

At first glance, those numbers may seem mixed, but revisions tell a deeper story.

Why revisions matter

Payroll numbers from October and November were revised down by a combined 76,000 jobs, and several unemployment rate readings from last year were revised higher. This suggests the labor market has been weaker than initially reported.

Where job growth came from

Most December job gains were concentrated in:

- Health care and social assistance (+ 39,000 jobs)

- Leisure and hospitality (+ 47,000 jobs)

Health care hiring tends to remain steady regardless of economic conditions, while leisure and hospitality often sees a seasonal bump during the holidays. When these sectors are excluded, overall job growth would have been negative — a sign of broader softness.

Bottom Line: The headline job number masks underlying weakness, especially outside of traditionally resilient or seasonal industries.

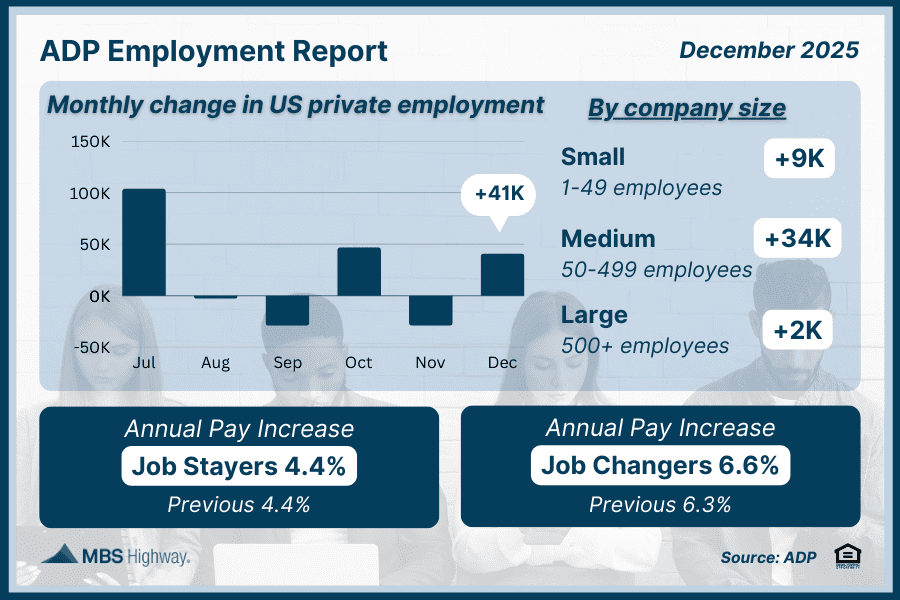

Private Payrolls Show a Modest Rebound — But Trends Remain Weak

According to ADP, the private sector added 41,000 jobs in December, recovering from a 29,000-job loss in November — but still missing expectations.

Who’s hiring

- Small businesses: +9,000 jobs

- Medium-sized businesses: +34,000 jobs

- Large employers: +2,000 jobs

Hiring was uneven across industries, with three out of ten sectors losing jobs. Education, health services, and leisure and hospitality again led gains, largely due to seasonal factors.

Wage growth trends

Workers who changed jobs saw wages rise 6.6% year over year, compared to 4.4% for those who stayed put — continuing a trend where job switchers benefit more.

Bottom line: While December showed a brief rebound, hiring momentum is clearly slowing. Private payrolls have grown by only 27,000 jobs over the past five months, signaling a meaningful cooldown.

Other Data Confirms a Cooling Labor Market

Beyond payroll number, several indicators point to softer labor conditions:

- Initial jobless claims increased to 208,000

- Continuing claims rose to nearly 1.9 million and remain elevated

- Job openings fell to 7.15 million in November

- Hiring and quit rates remain low, suggesting less confidence from bother employers and employees

While December job cut announcements were the lowest in over a year, employers announced 1.2 million job cuts in 2025, one of the highest annual totals since 1989. Hiring announcements were also at their lowest level since 2010.

Bottom line: Fewer job openings, elevated continuing claims, and weak hiring plans all reinforce the picture of a gradually cooling labor market.

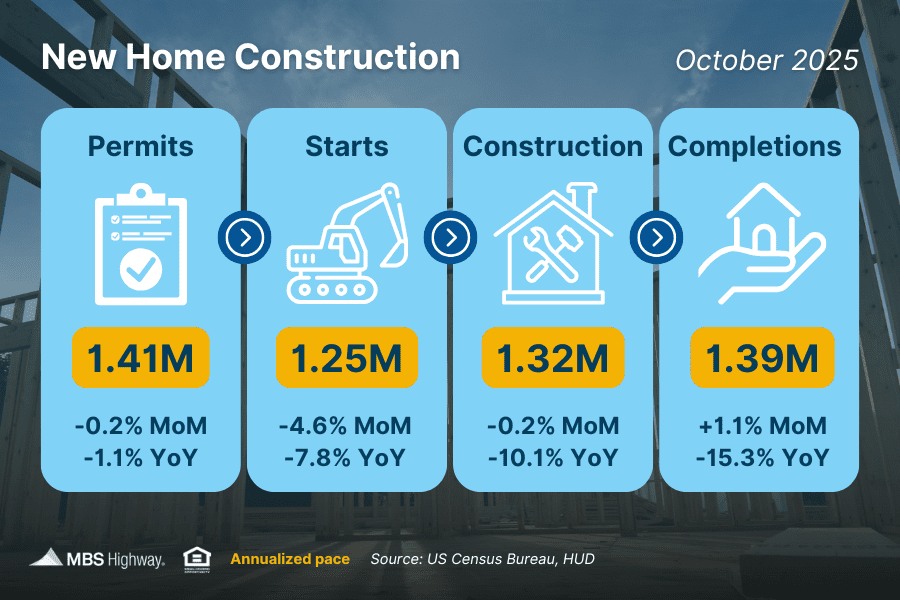

Housing Drops to Pandemic-Era Levels

New government data showed that housing fell 4.6% from September to October, reaching their lowest level since the early days of the pandemic. Building permits, a key indicator of future construction, also slipped slightly.

Why this matters

The housing market still faces a supply shortage, but adding new inventory takes time. Builders must move through the entire process — permitting, contrustion, and completion — before homes reach the market.

If mortgage rates continue to trend lower, buyer demand could rebound faster than supply, potentially putting renewed upward pressure on home prices.

Bottom line: Slower construction today could mean tighter housing supply tomorrow, especially if demand picks back up.

The Bottom Line

- Job growth is slowing, especially outside of seasonal and stable industries

- Hiring momentum is weakening across much of the private sector

- Labor market confidence appears softer for both employers and workers

- Home construction has pulled back, limiting future housing supply

While these trends don’t point to an immediate downturn, they do suggest an economy that’s losing steam. For consumers, this may mean being more cautious with finances — and staying informed as conditions continue to evolve.

At TEG, we’re committed to helping out members navigate changing economic conditions with confidence, whether you’re planning your next move or simply staying informed.

More Recent Posts